The Guided Wealth Management Statements

The Guided Wealth Management Statements

Blog Article

The Single Strategy To Use For Guided Wealth Management

Table of ContentsSome Ideas on Guided Wealth Management You Should KnowThe Main Principles Of Guided Wealth Management Everything about Guided Wealth ManagementSome Known Factual Statements About Guided Wealth Management What Does Guided Wealth Management Do?All about Guided Wealth Management

Picking an efficient monetary advisor is utmost crucial. Consultant roles can differ depending on several elements, consisting of the type of economic consultant and the client's needs.A limited consultant needs to declare the nature of the constraint. Supplying ideal strategies by assessing the background, monetary information, and abilities of the customer.

Guiding customers to apply the economic strategies. Regular surveillance of the financial profile.

If any type of problems are come across by the monitoring consultants, they iron out the origin and fix them. Develop a monetary threat analysis and review the possible effect of the risk. After the conclusion of the threat analysis version, the consultant will certainly assess the results and provide a proper option that to be executed.

Our Guided Wealth Management Statements

In many nations experts are utilized to save time and lower tension. They will certainly help in the achievement of the economic and workers objectives. They take the responsibility for the given choice. Because of this, customers require not be concerned about the decision. It is a long-lasting procedure. They require to examine and assess even more locations to straighten the ideal path.

However this brought about an increase in the net returns, price savings, and additionally directed the course to success. Several procedures can be compared to recognize a certified and experienced consultant. Usually, advisors need to satisfy typical academic qualifications, experiences and accreditation suggested by the government. The basic academic certification of the advisor is a bachelor's degree.

While looking for a consultant, please think about credentials, experience, skills, fiduciary, and payments. Look for clearness till you obtain a clear concept and complete fulfillment. Always guarantee that the suggestions you receive from a consultant is constantly in your best passion. Inevitably, monetary consultants maximize the success of a company and likewise make it grow and thrive.

Guided Wealth Management Things To Know Before You Get This

Whether you need somebody to aid you with your tax obligations or stocks, or retired life and estate planning, or all of the above, you'll discover your solution right here. Keep reading to discover what the distinction is in between a monetary advisor vs coordinator. Primarily, any type of specialist that can help you handle your money in some fashion can be thought about an economic consultant.

If your objective is to create a program to satisfy lasting economic objectives, after that you probably desire to get the services of a licensed monetary organizer. You can look for an organizer that has a speciality in tax obligations, investments, and retirement or estate planning. You might additionally ask regarding classifications that the organizer carries such as Licensed Monetary Coordinator or CFP.

An economic consultant is just a broad term to explain an expert that can assist you manage your cash. They might broker the sale and acquisition of your stocks, handle investments, and help you produce a thorough tax obligation or estate strategy. It is necessary to note that a financial advisor should hold an AFS license in order to offer the general public.

The Buzz on Guided Wealth Management

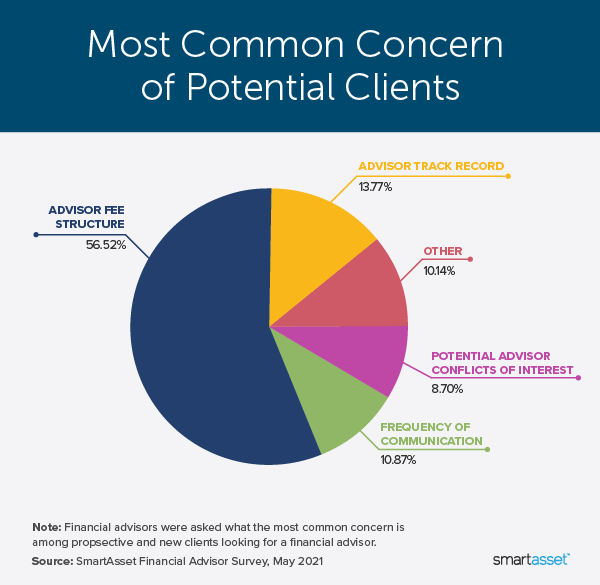

If your financial consultant checklists their services as fee-only, you ought to anticipate a checklist of services that they offer with a failure of those fees. These experts don't provide any type of sales-pitch and normally, the services are reduced and dry and to the point. Fee-based consultants bill an upfront charge and after that earn payment on the financial products you purchase from them.

Do a little study initially to be sure the financial advisor you work with will certainly be able to take care of you in the lasting. Asking for references is an excellent method to get to understand a monetary expert before you also satisfy them so you can have a much better idea of how to manage them up front.

6 Simple Techniques For Guided Wealth Management

You must constantly factor expenses into your monetary planning scenario. Meticulously evaluate the charge structures and ask questions where you have confusion or issue. Make your potential expert answer these questions to your fulfillment before relocating forward. You may be trying to find a specialty expert such as someone that concentrates on divorce or insurance policy planning.

An economic consultant will certainly assist you with establishing achievable and practical goals for your future. This might be either starting a company, a family members, intending for retirement all of which are essential phases in life that need cautious factor to consider. A financial consultant will certainly take their time to review your circumstance, short and long term objectives and make recommendations that are ideal for you and/or your family members.

A study from Dalbar (2019 ) has illustrated that over twenty years, while the typical financial investment return has been around 9%, address the average capitalist was just obtaining 5%. And the difference, that 400 basis factors each year over two decades, was driven by the timing of the financial investment choices. Handle your profile Shield your possessions estate preparation Retired life intending Handle your incredibly Tax financial investment and administration You will certainly be needed to take a danger resistance survey to supply your expert a clearer image to establish your financial investment possession allocation and preference.

Your advisor will certainly examine whether you are a high, tool or low threat taker and established up a property allowance that fits your danger resistance and capability based on the details you have actually offered. For instance a high-risk (high return) individual might purchase shares and property whereas a low-risk (reduced return) person might wish to invest in cash and term down payments.

The Greatest Guide To Guided Wealth Management

Once you engage a monetary expert, you do not have to manage your portfolio. It is vital to have proper insurance coverage plans which can provide peace of mind for you and your family.

Having an economic expert can be incredibly useful for many people, however it is important to weigh the benefits and drawbacks prior to choosing. In this post, we will certainly check out the advantages and downsides of collaborating with a monetary expert to help you choose if it's the best relocation for you.

Report this page